Have you heard the term ‘stagflation’ recently? Don’t worry, it’s not just a weird term that economists care about—it actually affects every one of our wallets!

In simple terms, stagflation means the economy is slow and lackluster, job opportunities are scarce, and unemployment is rising, yet prices are constantly on the rise. It seems strange, right? Because normally, when the economy is struggling and people have less money to spend, prices should go down, not up! This isn’t the first time we’ve seen such a phenomenon. The classic example is the United States in the 1970s during the oil crisis, when the country was both expensive and poor, making life difficult for everyone.

Why does stagflation happen? It usually occurs when there’s a sudden shortage of key resources like oil, resulting in skyrocketing production costs; compounded by geopolitical instability—recent events like the Russia-Ukraine war have complicated global supply chains, adding pressure to economies. High inflation plus stagnant growth leads to a vicious cycle where finding jobs becomes tougher.

As we move into 2025, many countries have yet to officially enter stagflation territory; however, with rising inflation pressure, high energy and raw material prices, and central banks maintaining high interest rates, key industries and consumer confidence have clearly slowed down. Particularly in some European nations and emerging markets, economic growth has nearly stalled, and unemployment is increasing, causing widespread concern about a potential expansion of ‘quasi-stagflation.’

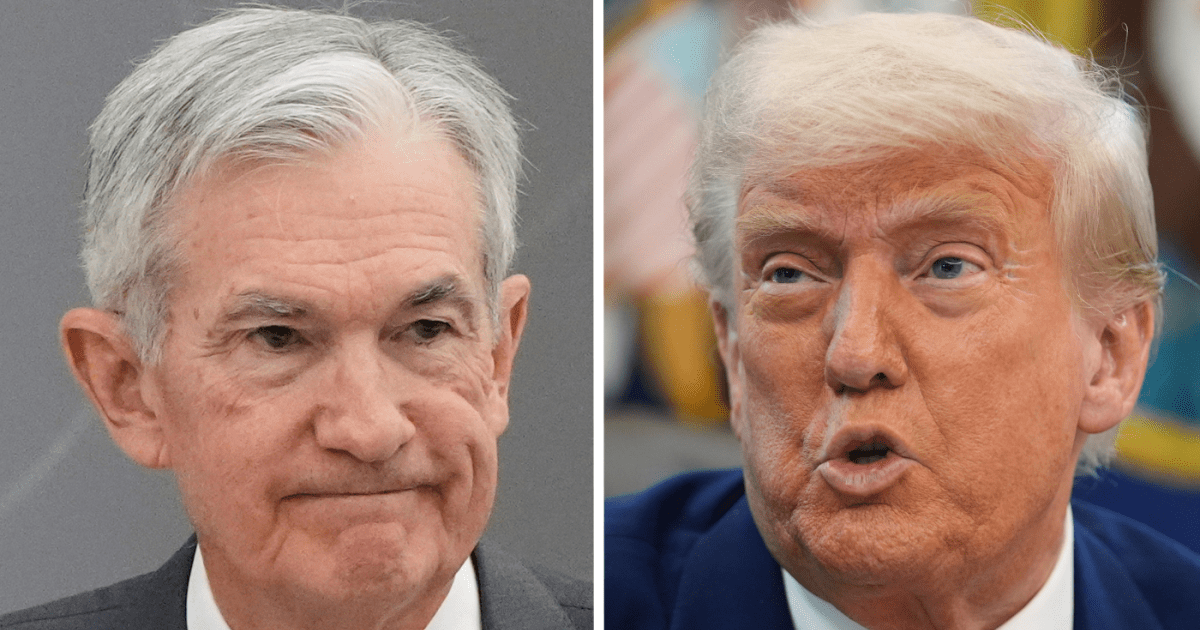

Recently, news of layoffs in the manufacturing and tech sectors has poured in, with demand for consumer electronics cooling down—definitely not great news for the global economy. Central banks, like the Federal Reserve, face a dilemma: if they crack down too hard on inflation, the economy will struggle even more; yet if they don’t act decisively, prices could spiral out of control. Even emerging markets are suffering due to capital flight, currency devaluation, and increasing costs for imported energy and food.

Many economists have yet to claim ‘we are truly in stagflation,’ but the triple blow of stagnation, high prices, and job difficulties is something we all fear encountering. How can we protect ourselves? Experts recommend keeping an eye on inflation and employment data, avoiding high-risk investments, and maintaining some financial flexibility to adapt to changes. If stagflation does occur, the life where ‘money is scarce and everything is expensive’ may be closer than we think.