Gold’s Record-Breaking Week: Surges Past $4,000, Sets New Highs

Gold’s Record-Breaking Week: Surges Past $4,000, Sets New Highs

In the past seven trading days, gold has powered through the $4,000 barrier to reach new all-time highs, fueled by continued US government shutdown, dovish Fed stance, and global geopolitical turmoil. Trading volumes have soared to near-records as investors flock to safe havens. Technicals remain bullish, but overbought readings suggest heightened caution near the highs, making key support and resistance levels crucial for short-term strategies.

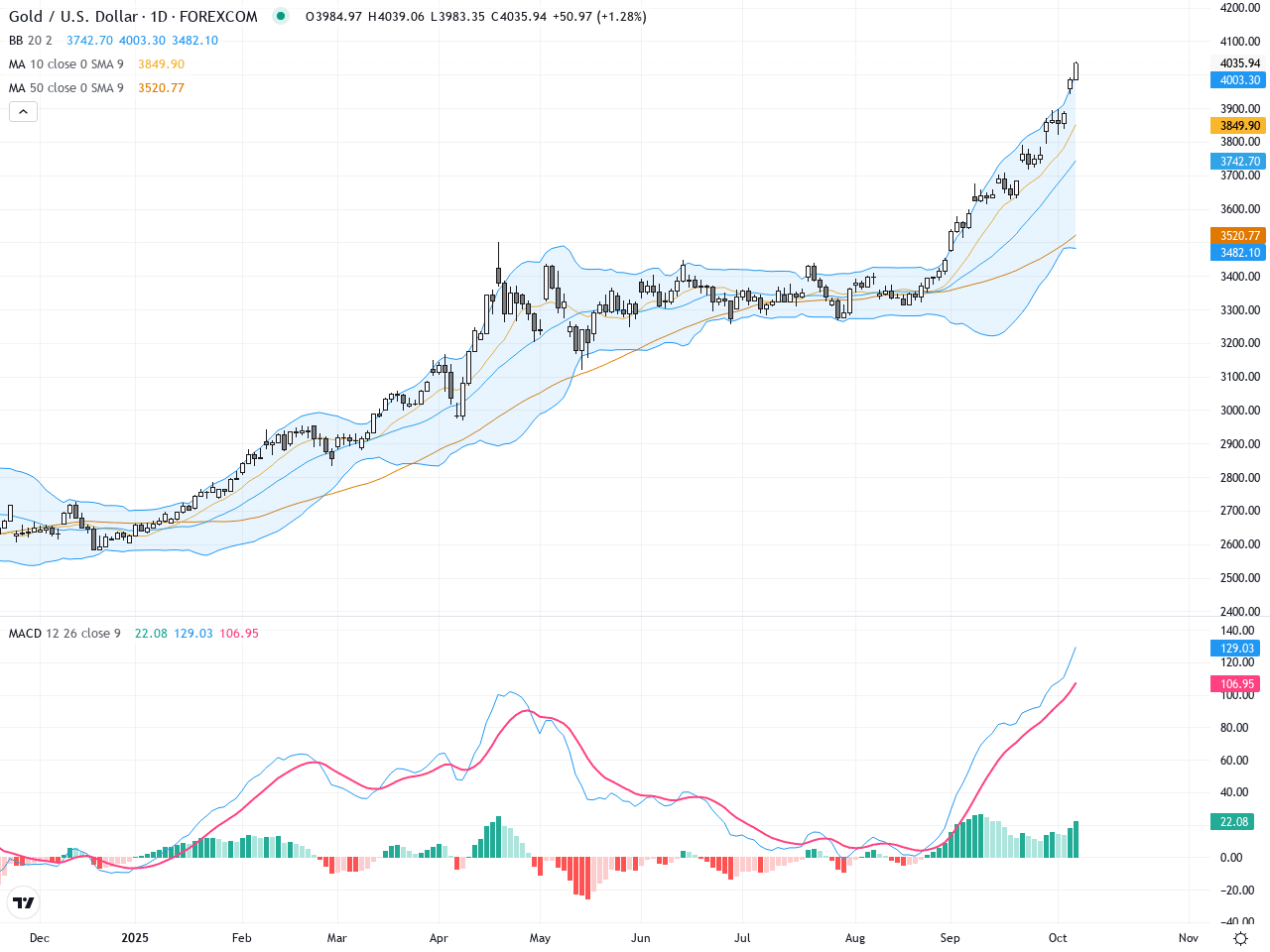

The daily chart shows a clear, powerful uptrend. The 20-day and 50-day moving averages are rising in bullish alignment, with price consistently above both, confirming strong positive momentum. Bollinger Bands have expanded sharply, reflecting high volatility; price has hugged the upper band, indicating persistent bullish pressure. MACD is widening above zero, histogram climbing, indicating strong momentum. Multiple large bullish candles appear, but the emergence of long upper wicks (e.g., shooting star patterns) near peaks warns of potential exhaustion and short-term pullbacks.

On the hourly chart, gold shows renewed upward movement following brief corrections; moving averages are in bullish formation. Repeated hammer candles with long lower wicks reflect solid buying on dips. MACD is flattening, showing momentum fading on short-term basis. Bollinger Bands have narrowed then expanded again, forecasting a possible imminent breakout. Volume surges on highs, but fading volume could spell upcoming consolidation, so watch for range-bound trading.

Technical momentum for gold remains robust, but with price at record highs, tug-of-war between bulls and profit-takers is likely. Extremely high volumes suggest intense market focus. Caution warranted for short-term traders: signals of MACD divergence, Bollinger Band over-extension, or drop below moving averages on the hourly chart could indicate corrective risk.

Gold is in a strong uptrend, but overbought conditions and volatility imply an increased risk of near-term consolidation or corrective pauses.

Resistane(1): 4040Resistane(2): 4110Resistane(3): 4200Support(1): 3970Support(2): 3910Support(3): 3850