Geely Automobile (0175.HK): Latest Technical Analysis & Market Overview

Geely Automobile (0175.HK): Latest Technical Analysis & Market Overview

Over the past seven trading days, Geely Automobile has shown volatile performance, struggling below key moving averages and lacking significant rebound momentum. Technical indicators reflect a weak consolidation, and low trading volume highlights cautious market sentiment driven by NEV sales data and Chinese macroeconomic releases.

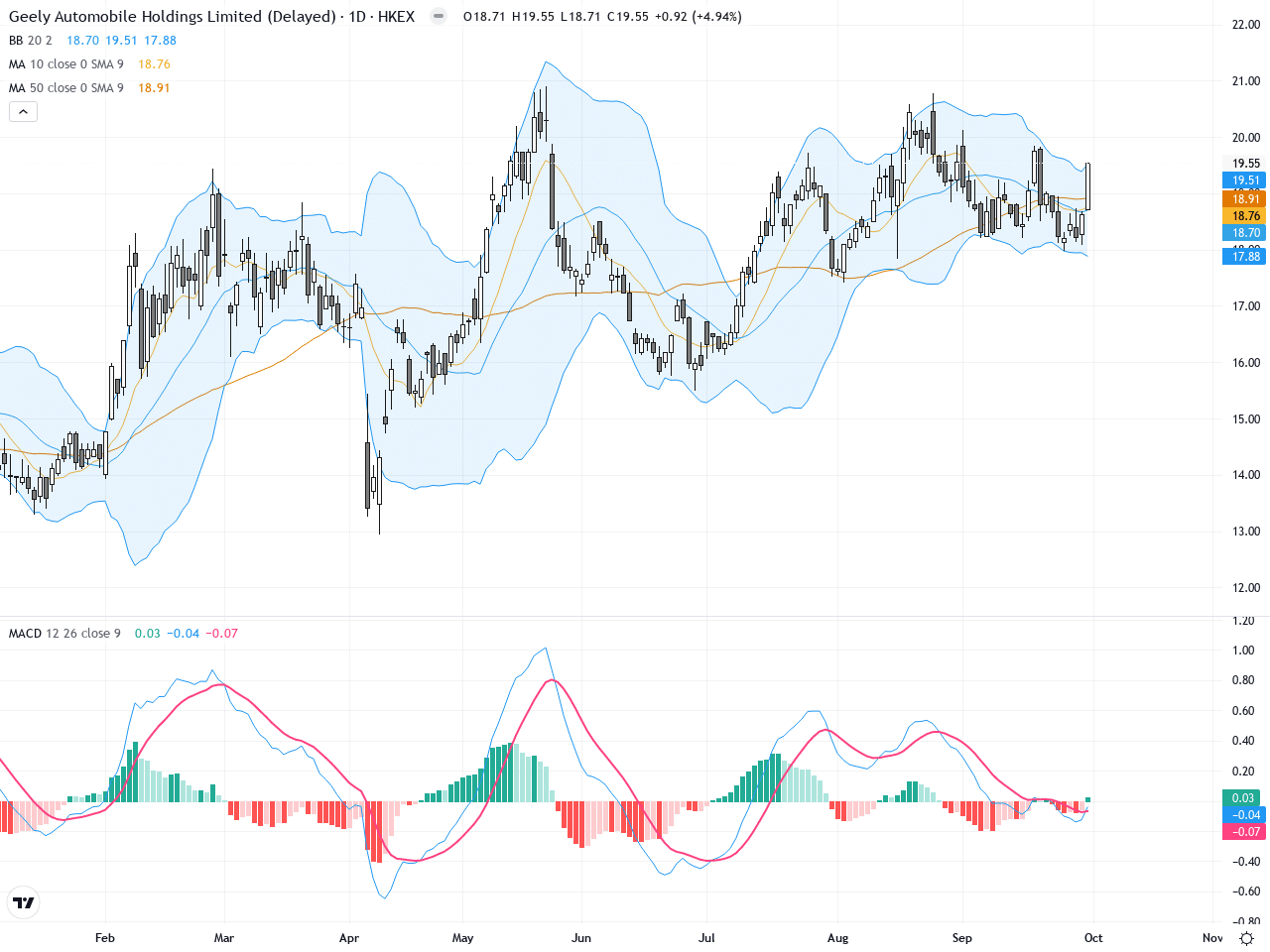

On the daily chart, Geely is trading below its main moving averages, with the 20-day and 50-day lines sloping down, indicating ongoing pressure. The Bollinger Bands remain compressed, suggesting lower volatility with no strong directional bias yet. MACD maintains a bearish crossover, signaling persistent downward momentum. There are frequent doji and hammer candlestick patterns, reflecting market indecision and investor hesitance.

The hourly chart shows a sequence of declines followed by tight range consolidation over the past three days. Short-term moving averages have crossed bearishly multiple times, and price recovery attempts are capped by mid-term resistance. Recent candlesticks include small bullish engulfing patterns, yet volume remains subdued, indicating sellers still lead. MACD and RSI readings stay weak, with no obvious reversal signals. Trading volumes are low, echoing a lack of conviction.

Technically, Geely is in a consolidation phase, capped by moving average resistance and with rebound attempts lacking strength. Daily chart doji and hammer patterns highlight buyer-seller conflict, while hourly chart action shows after-the-fall sideways moves and poor volume engagement. Watch for the next NEV sales reports and China auto sector news—these could trigger a breakout. Key technical levels remain pivotal for short-term strategies.

Geely Automobile is currently in a weak consolidation; after a decline, price action is mostly sideways, with no clear uptrend.

Resistane(1): HK$7.60Resistane(2): HK$7.80Resistane(3): HK$8.10Support(1): HK$7.20Support(2): HK$7.05Support(3): HK$6.80