News & Articles (EN)

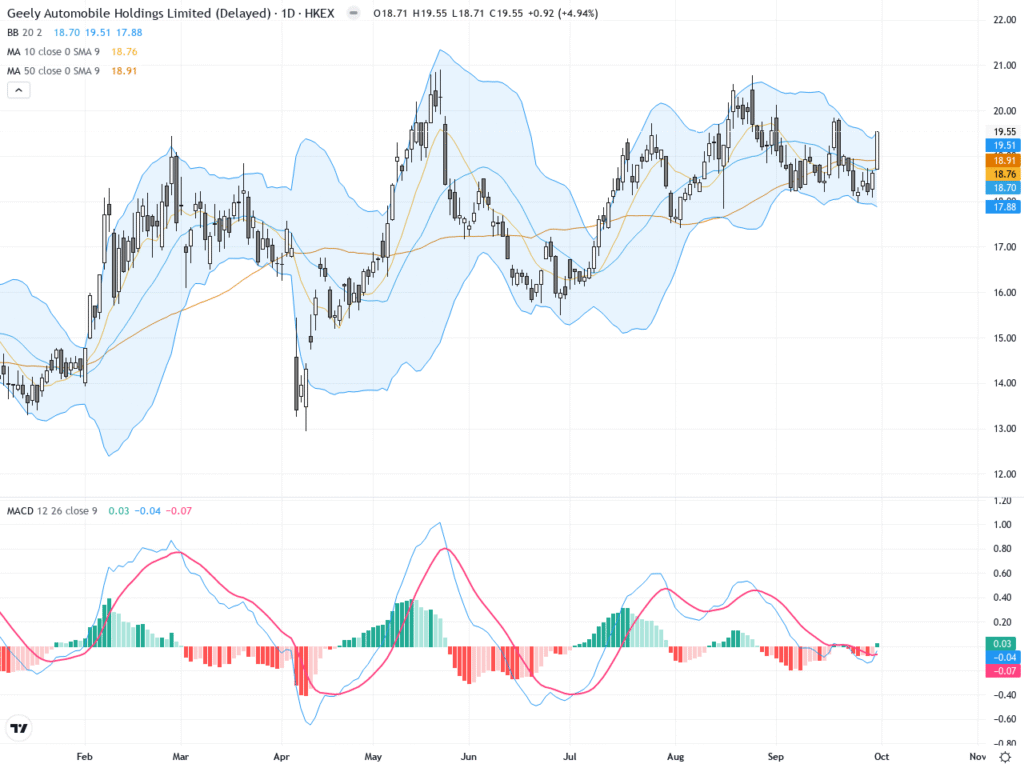

Over the past seven trading days, Geely Automobile has shown volatile performance, struggling below key moving averages and lacking significant rebound momentum. Technical indicators reflect a weak consolidation, and low trading volume highlights cautious market sentiment driven by NEV sales data and Chinese macroeconomic releases.

The $7,500 federal tax credit is set to expire on September 30, 2025, impacting market trends and consumer buying decisions. Now is the golden hour to purchase an electric vehicle before prices rise!

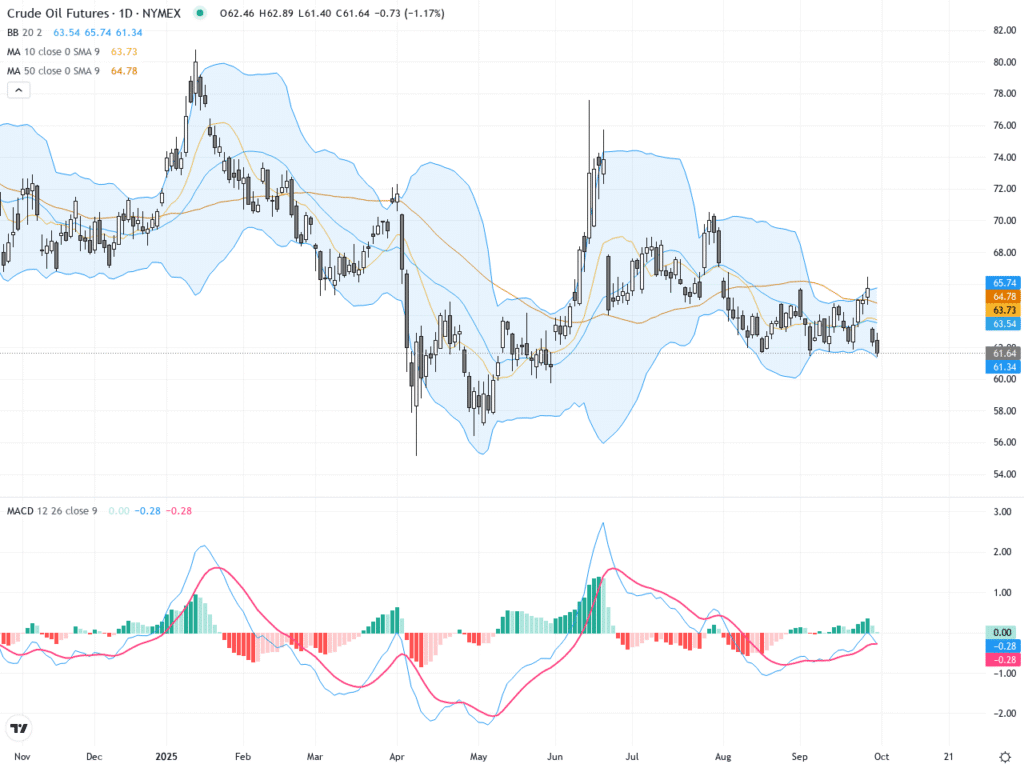

Over the past 7 trading days, WTI crude oil futures (CLc1) have shown a marked shift in trend, affected by heightened geopolitical risk, US crude inventory reports, and OPEC+ headlines. Key support and resistance zones have emerged as the market reacts sharply to new information. Technically, the price is entering…

Explore the evolution of avatars in the metaverse and how they shape our future virtual identities and social interactions.

When choosing a husband, the most important factor is not appearance or education, but his money attitude. To ensure a happy marriage, open communication about finances is crucial!

The latest financial report from the West Kowloon Cultural District reveals a deficit of HK$769 million, a six-year high, as basic income and donations plummet. The management is seeking diverse avenues to address economic challenges.

The US Dollar Index (DXY) has experienced heightened volatility in the past week, with a sharp decline ahead of the recent FOMC meeting swiftly followed by a robust rebound. This rebound was fueled by shifting rate cut expectations and unexpectedly strong US economic data. Technical resistance is evident near the…

In September 2025, global FX, commodities, and gold markets are shaped by diverging central bank policies, resilient emerging market growth, and moderated global economic momentum.

Silver (XAGUSD) experienced significant price volatility in the past week, surging to a 14-year high above $44 as anticipation of a US Federal Reserve rate cut and geopolitical tensions boosted demand, before retreating slightly amid cautious Fed outlook and mixed economic signals.

The US Dollar Index (DXY) has experienced heightened volatility in the past week, with a sharp decline ahead of the recent FOMC meeting swiftly followed by a robust rebound. This rebound was fueled by shifting rate cut expectations and unexpectedly strong US economic data. Technical resistance is evident near the…

In September 2025, global FX, commodities, and gold markets are shaped by diverging central bank policies, resilient emerging market growth, and moderated global economic momentum.

Silver (XAGUSD) experienced significant price volatility in the past week, surging to a 14-year high above $44 as anticipation of a US Federal Reserve rate cut and geopolitical tensions boosted demand, before retreating slightly amid cautious Fed outlook and mixed economic signals.